Competition Appeals Tribunal allows truck manufacturers to put forward mitigation defences in claim brought by 138 local authorities over cartel

- Details

Courts should not strike out cases because they are too complex, the Competition Appeals Tribunal has said in a long-running dispute over the European truck cartel.

Adur District Council had brought the case against 10 manufacturers on behalf of 138 local authorities that believe they were overcharged for vehicle purchases while the cartel operated.

The case dates from July 2016, when the European Commission found the cartel had existed.

It is now being managed with the Trucks Second Wave Proceedings and Adur applied to strike out, or alternatively obtain summary judgment in relation to, the truck manufacturers’ pass-on defences.

Sarah Abram KC, from Brick Court Chambers, who acted for three of the manufacturers, said they contended that, if the cartel led to an increase in the cost of trucks bought by local authorities, that increase was mitigated by being passed on through increased income or lower costs - for example council tax rises or prices charged for services such as bulky waste collection.

Local authorities said this was impossible because they are not profit-making bodies.

The case was heard at the Competition Appeal Tribunal by its president Sir Marcus Smith, Lord Ericht and Mr Justice Huddleston.

They said in a unanimous judgment: “The nub of the defendants’ case is that…the claimants’ strike out application should be refused.

“This is because in the present case the local authorities’ statutory obligation to balance their budgets, combined with the evidential material and the unchallenged expert evidence…establishes a realistic and plausible connection between any overcharge and the act of mitigation through increasing income/charges or decreasing costs.”

Adur had asked the tribunal to rule that, on grounds of legal policy, there was no realistic prospect of satisfying the test for legal causation and the manufacturers should not be permitted to rely on allegations of pass-on from a local authority to the taxpayer.

The tribunal said: ”Having heard the parties and considered the evidence…the tribunal fundamentally does not feel that the case for strike out or summary judgment as advanced by the claimants is made out and so dismisses the application.”

It took this view because “we do not feel that the threshold for a strike out has been met [because] the test is a high one.”

Strike out was problematic in cases such as this “where there are complex issues of fact and interrelated legal questions which, in turn, are further complicated when one attempts to overlay upon those the legal policy arguments”.

There was evidence of a triable case on the availability of pass-on as mitigation and “clearly a debate between the parties on the point as to the existence of pass-on in law and particularly on the facts as they relate to local authorities in particular but the existence or indeed extent of any pass-on is something that the tribunal feels can only be considered at a full trial based on a fuller understanding of the exact factual matrix and legal argument upon it”.

They added that it was neither “attractive or a legally robust argument” to suggest a strike out because the issues involved were “too complex”.

Judges said: “The courts frequently must grapple with complex issues and it would be our intention to do so here through robust and pragmatic case management to arrive at a proportionate way forward.”

Ms Abram said: “The CAT was satisfied that the evidence before it demonstrated at least an arguable connection between the price of trucks and local authorities’ income.

“It rejected the claimants’ argument that the pass-on issues would be ‘too complex' to be tried, noting that the complexity of an issue was not a reason not to engage with it, and that robust and pragmatic case management would be used to identify a proportionate approach.

“The legal argument that local authorities should be entitled to claim for any loss that they had passed on was described as 'a novel proposition in law’, which the CAT was not prepared to determine in advance of the trial.”

Mark Smulian

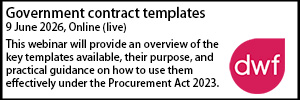

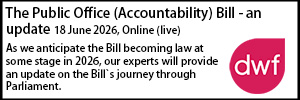

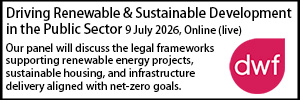

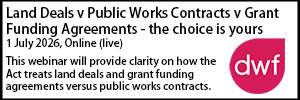

Sponsored articles

Walker Morris supports Tower Hamlets Council in first known Remediation Contribution Order application issued by local authority

Unlocking legal talent

Legal Director - Government and Public Sector

Contracts Lawyer

Lawyer (Planning and Regulatory)

Locums

Poll

15-07-2026 11:00 am