Trading places

- Details

Changing times, shrinking budgets and increased political focus are forcing all in local government to look well beyond traditional turf. For just because it always was doesn’t mean that that’s the way it will always be. Or indeed is.

Changing times, shrinking budgets and increased political focus are forcing all in local government to look well beyond traditional turf. For just because it always was doesn’t mean that that’s the way it will always be. Or indeed is.

Because for many local government lawyers the winds of change have already been blowing fresh and keen - and for some time. The London Boroughs of Merton, Richmond, Sutton and Kingston, for example, are just the latest to have agreed a co-ordinated legal operation. And various permutations and combinations of service share have been mushrooming across the land as legal leaders and their teams have risen to the challenge of creative austerity.

If the current legal powers backdrop is a lot more encouraging (particularly with the manifestly broad general power of local authority competence) the regulatory climate is also set to warm up a touch. Currently, although Practice Framework Rule (PFR) 4(15)(e) has allowed local government employed solicitors to act for local charities, it prevents charging. But on 27 February 2013, the SRA Board accepted a recommendation to enable local government solicitors to charge charities ‘whose objects relate wholly or partly’ to the employer authority’s area. And under PFR 4(15)(a) local authority solicitors may already act for another organisation or person to whom their authority is statutorily empowered to provide legal services as well as (per PFR 4(15)(c)) for specified local authority associated companies.

To trade – and if so how?

With legal services departments already between the rock of increasing demand and the hard place of budget reductions, once an in-house practice has been ‘leaned-up’ to be as fit, efficient and effective as possible, and practical working synergies (such as shared services) are running successfully (no small task, organisationally, managerially, culturally, administratively and politically!), getting in some additional external fee income is an obvious next step. Two broad routes are available.

One is trading (by the internal local authority legal practice) with other public bodies under the Local Authorities (Goods and Services) Act 1970. This (amongst other things) enables a local authority to provide administrative, professional or technical services, for a fee, to specified or designated public bodies. A large variety and number of public bodies have been designated by ministerial order (under section 1(5) of the 1970 Act) and these include government departments as well as health, housing, leisure and many other public bodies.

The Court of Appeal in June 1997 gave the green light to extensive 1970 Act trading activity (see Regina v. Yorkshire Purchasing Organisation, ex parte British Educational Suppliers' Association 95 LGR 727). Simon Brown LJ indicated that whilst those "enacting this legislation would have been surprised, perhaps even shocked, to see the limits to which Y.P.O. has taken it" he could nevertheless "see no basis whatever for construing this legislation restrictively so as to prevent it".

The other broad trading route is a trading company established under local authority trading powers in section 95 of the Local Government Act 2003 or section 4 of the Localism Act 2011. Whilst both require trading through a company (i.e. within section 1(1) of the Companies Act 2006, or a society registered or deemed as such under the Co-operative and Community Benefit Societies and Credit Unions Act 1965 or the Industrial and Provident Societies Act (Northern Ireland) 1969)), the 2011 Act is broader since it extends the power to trade beyond the 2003 Act basis of pre-existing functional powers. According to a 21 March 2011 letter from Secretary of State, Eric Pickles, to the Chair of the Communities and Local Government Select Committee, the corporate vehicle requirement is to "reflect government policy that local authorities should not be able to use their public status to gain commercial advantage over the private sector".

So which route to choose? The 1970 Act gives considerable scope for providing legal services to one of the large number of designated public bodies from within the local authority. This does offer significant advantages in terms of premises and other costs, staffing, books, equipment, insurance etc. And (per the YPO case) there is no reason why such trading cannot be extensive. The key disadvantage is that the 1970 Act does not enable trading with the private sector.

For such trading the corporate trading route is necessary. That would need regulatory approval (as an ABS or otherwise) depending upon the precise configuration proposed (see the SRA website for information). Subject to that (and of course necessary legal, fiduciary and audit processes by the authority to ensure that public assets are not being transferred below value for private profit), local authority legal entities are free to set sail upon open trading seas.

But there is also apparently another dimension. This concerns the Local Government (Best Value Authorities) (Power to Trade) (England) Order 2009, S.I. 2009 No. 2393 made under the 2003 Act. This enables best value authorities (which (per section 1 of the Local Government Act 1999) include English local authorities and various other public bodies) ‘to do for a commercial purpose anything which it is authorised to do for the purpose of carrying on any of its ordinary functions’.

Although this wording is taken from section 95(1)(a) of the 2003 Act (the enabling power), it is arguably also applicable to trading under the 2011 Act, since this appears to be ‘overlapped’ by the 2003 Act. For section 2(1) of the 2011 Act provides that if ‘exercise of a pre-commencement power of a local authority is subject to restrictions, those restrictions apply also to exercise of the general power so far as it is overlapped by the pre-commencement power’.

On this basis, before trading, the 2009 Order requires authorities to prepare a business case in support of the proposed exercise of the power to do so and approve that business case. A ‘business case’ for these purposes is a comprehensive statement as to: '(a) the objectives of the business, (b) the investment and other resources required to achieve those objectives, (c) any risks the business might face and how significant these risks are, and (d) the expected financial results of the business, together with any other relevant outcomes that the business is expected to achieve'. In any event the preparation of a business case before speculation with public monies is a prudent step reasonably to be expected in line with the fiduciary duty.

However, in addition, the 2009 Order requires the authority to ‘recover the costs of any accommodation, goods, services, staff or any other thing that it supplies to a company in pursuance of any agreement or arrangement to facilitate the exercise’ of the trading power. This is again presumably to avoid the local authority trading entity gaining a commercial advantage over private sector competitors. In any event the fiduciary duty is likely to impose similar requirements to ensure that public resources are properly utilised in the public interest.

If this argument is correct and the 2009 order (or similar requirements) are indeed applicable to competence power trading, many of the corporate trading advantages apparently fade or disappear. And of course the more the trading entity becomes part of the private sector, the more it will be subject to private sector costs pressures (e.g. accommodation, staffing, regulatory, books and equipment, professional indemnity insurance, business development, administrative costs etc.) as well as competitive forces. Furthermore, although local authority terms and conditions may not feel particularly generous to those receiving them, they would be a noticeable cost to a business entity on a TUPE transfer which will need to generate enough revenue to meet them together with all other costs whilst leaving some funds available for necessary maintenance and investment. The toughness of the commercial environment may be illustrated by recent high profile law firm failures (the latest of which is Midlands law firm Blakemores, where SRA’s intervention was announced on 11 March 2013).

There is also of course the issue of procurement. Local authority legal departments generally having the benefit of shelter (to a greater or lesser extent) from private sector costs pressures should be able to tender competitively to other local authorities and public bodies under the 1970 Act and also because their bids will not need to cover profit. Specific authority expertise and experience will also be attractive. However, tendering from a corporate entity which has been substantially severed from local authority apron strings is likely to be much tougher. For whilst the experience and expertise will no doubt still be there, the costs burden is likely to be significantly higher. And, in relation to an external entity which was once internal, an authority cannot of course give sentimental preference.

Legal world spinning ever faster

Creative thinking is clearly going to be increasingly necessary as both local authority and legal worlds spin ever faster. However, it seems to me that, certainly in the first instance, the 1970 Act offers authority practices the best introduction to legal trading. If that takes off and flies (as it seems for example to have done in Kent, where Director of Governance & Law, Geoff Wild, has also formed a strategic alliance with law firm, Geldards) then this could point towards taking the more private corporate plunge (with or without local authority wet suit) if a keen strategic analysis indicates that this is likely to be the best option for all concerned. But, as the old saying has it, all that glitters is not gold.

There are in addition common climatic issues facing all legal practices, public and private. One is heightened customer expectation in an age of 24/7 online service delivery. Another is the commercial realisation by big retailers and other business players (e.g. the Co-op) that much of what many legal operations do is mechanical commodity work that can effectively be done either by machine or those with limited knowledge, skill or experience. In other words cheaper and more junior rather than dearer and more senior.

But whilst the conveyer belt of legal widget production will undoubtedly continue - if increasingly cheaply - for we all need bread as well as banquets, future value is likely to lie in high discretion work i.e. where sophisticated and experienced legal brains engage with the client’s particular situation to create pragmatic and legally sustainable, client-friendly solutions. Although the bar is certainly strong on law, solicitors often have the advantage of being close to their client’s business and may therefore be better able to offer strategic commercial as well as legal advice. But any parts of the profession currently snoozing along in denial are likely to have a harsh awakening when the reality alarm shrills.

Dr Nicholas Dobson is a Senior Consultant with Pannone LLP specialising in local and public law. He is also Communications Officer for the Association of Council Secretaries and Solicitors.

Contracts Lawyer

Legal Adviser

Regulatory/Litigation Lawyer

Antisocial Behaviour Legal Officer

Deputy Director Legal and Democratic Services

Legal Director - Government and Public Sector

Solicitor - Litigation

Solicitor/Lawyer (Contracts and Procurement)

Governance Lawyer

Lawyer (Planning and Regulatory)

Locum roles

Masterclass – MCA and Court of Protection - Legal Update - Peter Edwards Law Training

Masterclass – MCA and Court of Protection - Legal Update - Peter Edwards Law Training

21-01-2026

Online (live)

Managing settlements: the legal and practical issues, and the pitfalls to avoid - Blake Morgan

Managing settlements: the legal and practical issues, and the pitfalls to avoid - Blake Morgan

22-01-2026 10:00 am

Online (live)

Children and Young People (DoL, Competency and Capacity) - Peter Edwards Law Training

Children and Young People (DoL, Competency and Capacity) - Peter Edwards Law Training

28-01-2026

Online (live)

HMPL Building Blocks: Legal Tools to Combat Anti-Social Behaviour - Devonshires

HMPL Building Blocks: Legal Tools to Combat Anti-Social Behaviour - Devonshires

17-02-2026

Online (live)

Freedom of thought, belief and religion: Article 9 ECHR - Francis Taylor Building

Freedom of thought, belief and religion: Article 9 ECHR - Francis Taylor Building

19-02-2026

Online (live)

Grappling with S73 - variations of conditions applications or appeals - Ivy Legal

Grappling with S73 - variations of conditions applications or appeals - Ivy Legal

09-03-2026

Online (live)

HMPL Building Blocks: Tenancy Management – Assignment, Mutual Exchange and Succession - Devonshires

HMPL Building Blocks: Tenancy Management – Assignment, Mutual Exchange and Succession - Devonshires

12-03-2026

Online (live)

Section 31(2A) Senior Courts Act: where have we got to? - Francis Taylor Building

Section 31(2A) Senior Courts Act: where have we got to? - Francis Taylor Building

18-03-2026 1:00 pm

Online (live)

Save the Date: The Law of Public Rights of Way, Commons and Town or Village Greens Seminar (Hybrid) - Francis Taylor Building

Save the Date: The Law of Public Rights of Way, Commons and Town or Village Greens Seminar (Hybrid) - Francis Taylor Building

25-03-2026

London

HMPL Building Blocks: A Housing Officer’s Guide to Court Proceedings - Devonshires

HMPL Building Blocks: A Housing Officer’s Guide to Court Proceedings - Devonshires

14-04-2026

Online (live)

First Aid Level 3 - LBL Skills

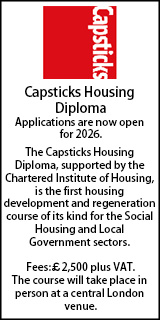

First Aid Level 3 - LBL Skills  Capsticks Housing Diploma

Capsticks Housing Diploma  Standish 18 months on - 42BR

Standish 18 months on - 42BR  Accelerating EV Charging Infrastructure in the Public Sector - DWF

Accelerating EV Charging Infrastructure in the Public Sector - DWF  Building Safety Act Conference 2026 - Landmark Chambers

Building Safety Act Conference 2026 - Landmark Chambers  Education Law Conference - 3PB

Education Law Conference - 3PB  Annual Planning Seminar 2026 - No.5 Barristers

Annual Planning Seminar 2026 - No.5 Barristers